Benefit Formula Basics

If you're a state employee (including college and university employees), you may wonder how your monthly base benefit* is calculated at retirement. It's as easy as 1, 2, 3!

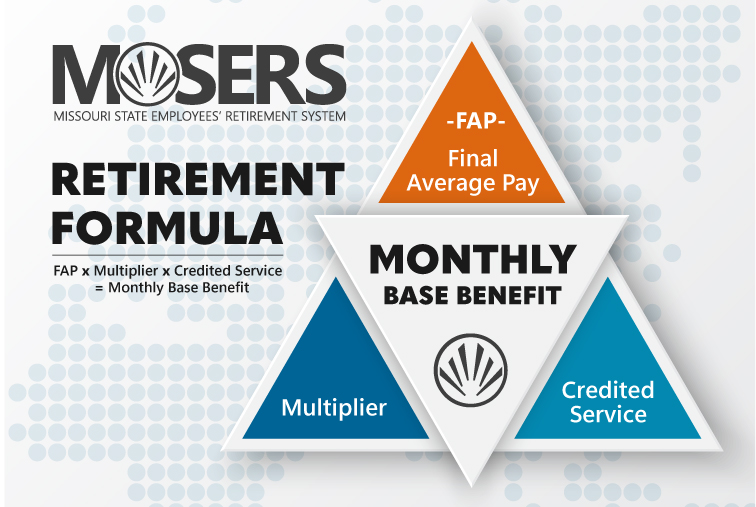

MOSERS uses a three-part formula to calculate your monthly base benefit. This formula, as defined by law, considers the following factors:

- Final Average Pay (FAP) – The average of your highest 36 consecutive months of compensation.

- Multiplier – A number established by the legislature (1.6% or 0.016 for MSEP; 1.7% or 0.017 for MSEP 2000 and MSEP 2011).

- Credited Service – Your years and months of credited service earned, purchased, or transferred, and unused sick leave (if applicable).

Learn more about the benefit formula breakdown in the Summary of Pension Benefit Provisions (All Plans) and by plan on our website: MSEP, MSEP 2000, and MSEP 2011.

Generate a benefit estimate online by logging in to myMOSERS and selecting Estimate My Retirement Benefit from the I want to… menu. Enter your retirement date, spouse’s date of birth (if applicable), the last day you will work, and any unused sick leave hours or outside service months.

Next, select your benefit payment option, then click Calculate to see your estimated monthly benefit amount at retirement. Thinking you will soon get a raise? You now have the option to include a projected monthly pay rate and a projected pay rate start date in your benefit estimate (if applicable).

You can also request a benefit estimate by contacting a MOSERS benefit counselor.

*Base benefit is the amount before any reductions, taxes, or other deductions.