Funding

Your promised pension benefits are an obligation of the state and they are secure.

Only a portion of the entire cost of pensions comes from the state. Employees also contribute, through a required payroll deduction, toward their future retirement income. MOSERS investment staff use the employer and employee contributions to generate the largest source of System funding: investment income.

MOSERS has been providing employee benefits for more than 60 years. Our mission is to advance the financial security of our members. That is why we work hard every day to ensure the long-term sustainability of the System.

Fiscally Sound

The MOSERS Board of Trustees is taking strategic action to make MOSERS more fiscally sound. They recently:

- Reduced the assumed rate of return on investments (ARR) from 7.10% to 6.95%. While this will cause the employer contribution rate to increase in the short term, it will work to help ensure MOSERS' sustainability over the long term.

- Authorized a one-time pension buyout program (2017- 2018) for vested former state employees. This resulted in a net reduction in system liabilities of $41 million.

- Oversaw the implementation of an investment portfolio that better serves the needs of stakeholders, as described in the Investment Policy Statement.

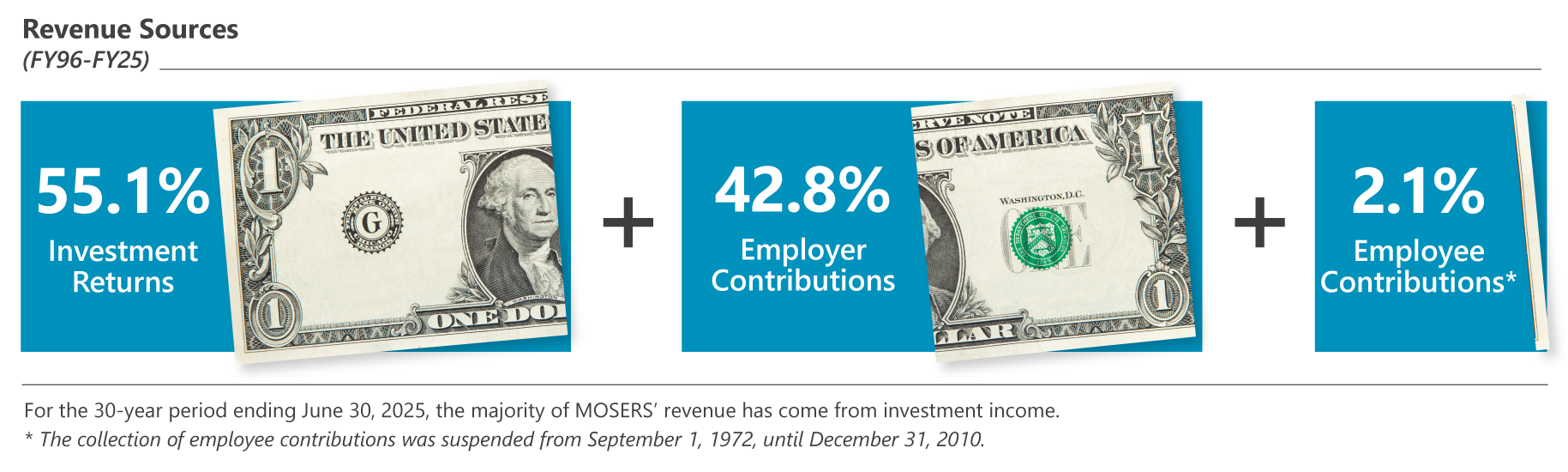

Where does MOSERS funding come from?

As noted above, investment earnings are the largest source of funding for paying pensions to retirees. The money we invest comes from both employer contributions and employee contributions.

- 55.1% from investment income

- 42.8% from employer contributions

- 2.1% from employee contributions

We distribute more than $1 billion in pension benefits annually.1

Funding for Public Pensions Means Funding for Missouri

Our Economic Impact reports show the significant, positive impact of MOSERS pension benefits on our economy.

- MOSERS currently pays pension benefits to 56,205 retirees and beneficiaries.2 (MSEP and Judicial Plan)

- The average pension benefit for MOSERS MSEP retirees and beneficiaries is $17,750 per year.2 This modest benefit provides those who served the public during their working years with income to meet their basic needs in retirement.

- Nearly 90% of retirees3 and their dependents remain in Missouri spending their pension income on housing, goods, and services in our local communities.

2 Actuarial Valuation as of 6/30/2024

3 IT Report: PDSH002 as of 6/30/2024

Committed to Transparency

The MOSERS Annual Comprehensive Financial Report provides a complete overview of the System's financial condition. Each year, we publish the full Annual Comprehensive Financial Report to our website and send our Summary Annual Report to all members.